- Secretary of state ohio business license search update#

- Secretary of state ohio business license search registration#

UpCounsel only accepts the top 5 percent of lawyers to its site. If you need help with an Ohio business address change, you can post your legal need on UpCounsel's marketplace.

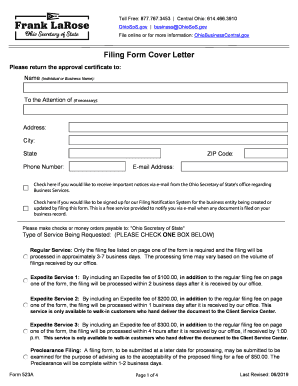

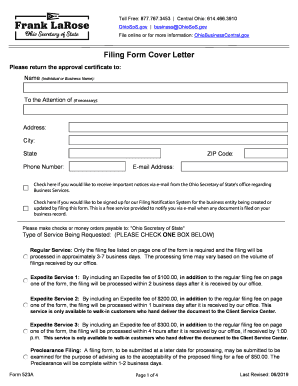

Be sure to include all the requested information, and send it to the designated address along with the required filing fee.

Secretary of state ohio business license search registration#

File a registration under the name as if it was a completely new business, which can be done with Form 534A.Conduct a search on the Ohio's secretary of state website to verify if your newly chosen name is available.

Fill out all the requested information on the form and mail it, along with payment of the processing fees, to the listed address.Check off Box four, located at the top of the form, which says “Cancellation of Registration.”.

Secretary of state ohio business license search update#

File Form 524, the Name Registration Update form, with the Ohio secretary of state's office. Despite the additional cost, it may be worth it if you have found a name that better represents your brand, or research has shown that a different name will be easier to remember. It will cost you more to file the change fee than when you filed your original paperwork, since this involves filing two forms with the secretary of state. Changing an Ohio Business NameĬhanging your company's name in Ohio is a relatively simple process. In addition, you may need to submit a change for your Employer ID number (EIN) if you are moving to a different state. IRS Form 8822, Change of Address, is what you will send to the IRS. Verify what your new state requires in regard to obtaining the same permits and licenses you already had. You will need to cancel old permits and licenses in your prior state. When you move your business to a new state, you will need to register with the Department of Revenue to collect state sales tax and any other taxes you may owe. Double check what the state requirements are before letting your registration lapse, as well as with the new state on what their requirements are. If you have an LLC, you may not have to set up a new business, but simply register as a foreign business in your new state.īusiness owners who do not plan to come back to their state at all can, in many cases, let the state registration lapse others may require you notify them when you are leaving. Register your business with the Ohio Secretary of State (see pages 4-6) Search the business name you want to use in the Ohio. Other types of licenses and registration are based on the business’ legal organization, the types of goods or services offered or business activities. If you are moving your business out of Ohio, you will need to register your business as a legal entity in the new state, which is done through that state's secretary of state office. businesses to register with the Ohio Secretary of State’s office. Don't forget to check the status of other local licenses and permits in your new county, and let the current county know where you are moving to. You will need to notify the old department to cancel your old account, as well as notify the new department so they can set up an account for your business. Notify the State Department of Revenue of your new address, so they know where to send updates on: There may be a small fee associated with an address change. These steps also apply if you plan to move your business out of state. Sole proprietorships who have registered their business name in the state should also inform the secretary of state on a change of address. You may need to amend your original Articles of Organization for an LLC and Articles of Incorporation for a corporation to reflect the move. You will also need to complete IRS Form 8822 for an intrastate move. You will also need to let the secretary of state know and file a new fictitious name or doing business as (DBA) name in the new county. If you move out of your current city or county, you will need to advise the old location of the move and apply for a business license in the new city. On your forms, you can designate if you are just changing your mailing address or if the address where you receive legal matters is also changing. No matter where you plan to move, whether it's in Ohio or to another state, you will need to notify the new agencies in the location you plan to move. Changing an Ohio Business NameĪn Ohio business address change is required when you are moving the physical location of your business within the state.

If you would like to print this list, click here.1.

0 kommentar(er)

0 kommentar(er)